2016 will be a year of numerous opportunities, bringing with it new challenges. One of our Company’s greatest daily challenges, something we take very seriously is finding ways to effectively save our clients valuable time and money.

2016 for Credit One is about helping you get out of debt and own your assets sooner

2016 for Credit One is about helping you get out of debt and own your assets sooner

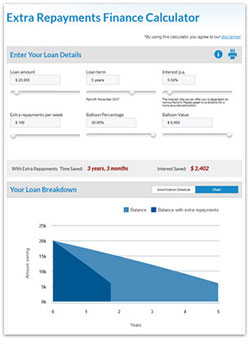

We are happy to announce that we have implemented a new Loan Repayment Calculator on our website. What’s different about this calculator from every other calculator you might ask? Well, our new calculator with extra repayments functionality can show you how making additional repayments, even small ones can dramatically reduce the time it takes to pay off a loan and in turn significantly reduce the interest you pay on your loan.

Our Extra Repayment Loan Calculator lets you choose an additional repayment amount from $1.00 to $1,000 and instantly tells you how much time you could save on your loan and how much you can reduce the interest payable across the term of your loan. With a simple click, you can easily view your individual results either weekly, fortnightly or monthly depending on which one suits you best. You will be able to see how much your total repayment will be including your extra repayment, how much you will save in interest and how much time you can reduce off your loan based on your input.

How else can I save money on my loans?

You can also save money on your loan by making more frequent repayments. For example, if you get paid weekly or fortnightly, you could reduce the amount of interest you pay on your loan by paying your loan repayments weekly instead of monthly. Because interest is compounded daily, the earlier you make a repayment, the less daily interest gets added to your loan each month, so if you can make repayments weekly, then consider doing so.

Other than making additional repayments, how can I save money on my car, bike, caravan or boat loan?

The best way to save money on your loan, whether you’re looking at car finance, caravan finance, marine finance or motorbike finance is to ensure you get the best product on the market for your individual circumstances.

You can always choose to apply for finance through your own bank, however there are some potential downsides to this option. Your bank may have a range of secured loan and personal loan products with ‘ok’ rates. However, using a Credit One Finance Consultant who has accreditations with over 30 leading Australian lenders means that we compare not only your bank’s loan products, but we can also compare hundreds of other major lender’s products for you to ensure you get the best rate finance package.

We also offer competitive rates on comprehensive insurance products, Australia-wide extended warranties and Loan Protection Insurance with Instant Online Finance Quotes, same-day approvals and independent, unbiased service. Speak to one of our friendly Finance Consultants today to see why we were named Swann Insurance’s ‘Broker of the Year 2015’. After all, over 100,000 Australian’s who choose Credit One for their finance needs can’t all be wrong.

Or speak to one of our friendly consultants on 1300 273 348 (1300 CREDIT)

Tags: Additional Repayment Finance Calculator, Repayment Calculator